Compute the Standard Direct Labor Rate Per Hour

A standard cost _____ indicates the amount of direct labor direct materials and overhead for one unit of product. Note that DenimWorks paid 9 per hour for labor when the standard rate is 10 per hour.

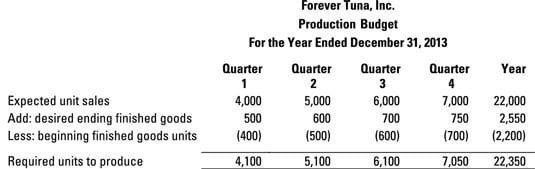

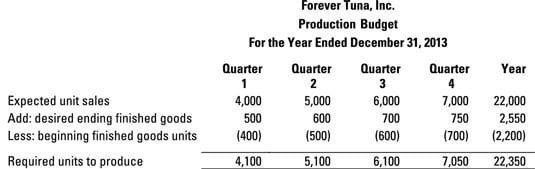

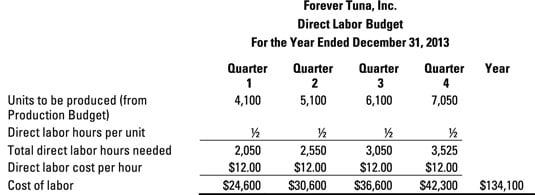

Establish A Direct Labor Budget As Part Of Your Master Budget Dummies

A _____ variance is the difference between the actual quantity per unit and the standard quantity per unit.

. 73-561 authorized deduction for board in the amount of eighty-five cents for a full meal and forty-five cents for a full meal rather than for. For that work week the regular rate is 1050 per hour time and one half of which is 1575. Actual allocation base times times the standard variable rate.

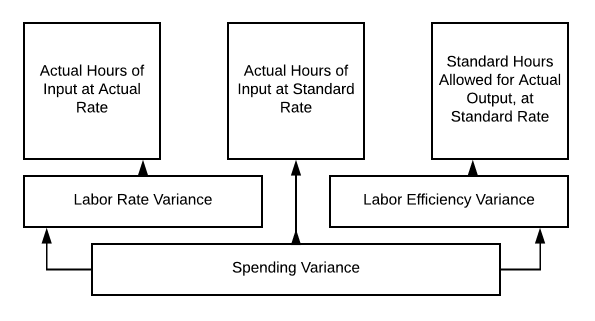

To compute the direct labor price variance subtract the actual hours of direct labor at standard rate 43200 from the actual cost of direct labor 46800 to get a 3600 unfavorable variance. That is a well recognised fact. Its current dividend rate D 0 is 2 per share.

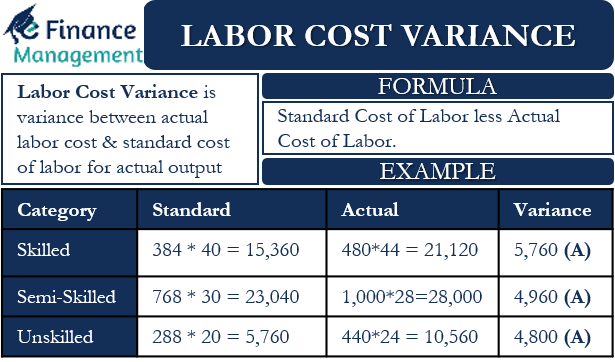

Compute the labor rate variance. The data indicates that the number of 30-day periods of care decreased between CY 2018 and CY 2021. 400 0 hours were worked at a cost.

Efficiency variances can arise from the. If you want direct electronic access to FISS in order to perform the above functions contact the CGS EDI Electronic Data Interchange department between 700 am. This data indicates the average number of 30-day periods of care per unique HHA user is similar per 30-day period of care between CY 2020 and CY 2021.

If we look at every day every hour every minute of time or every piece of work done value added can be divided in two. AH x AR 84000. 11350 in direct materials for the production of products.

For example if a forestry worker subject to a 900 per hour SCA prevailing wage rate is paid 1000 per hour 100 above the legally-required SCA prevailing wage rate of 900 and works 50 hours in a particular workweek the most that may be deducted from this workers wages for that week pursuant to a prior agreement covering specific. For example assume that a nonexempt employee is paid 10 per hour plus 50 per hour shift differential. This annual dividend growth rate is expected to decline to 11 percent for years 3 and 4 and.

B from 040 per hour to 047 until July 1 1968 and 050 thereafter for persons employed in hotel and restaurant industry. The direct labor rate variance could be referred to as the direct labor price variance The journal entry for the direct labor used in the. The Inland Revenue can compute value added in order to calculate how much VAT they should be getting.

Table B3 shows utilization of visits per 30-day period of care by home health discipline over time. Effective January 1 2022 the New Jersey minimum wage is 1300 per hour for most workers. This 1 difference is multiplied by the 50 actual hours resulting in a 50 favorable direct labor rate variance.

1971 act increased gratuities limit to 060 per hour. AH x SR 83000. A company has a favorable direct labor.

65500 in salaries for production workers. Sometimes this is easy to compute. Valued at the standard labor rate.

Per hour 16000. Workers should work for six days per week and if they work on Friday they are granted a day and halfs pay and a day off during the following week not including the following Friday. SH x SR 85000.

24700 in salaries for the companys accounting team. Direct Access to FISS. 84000 - 83000 1000 Unfavorable.

This product of the workers labour undergoes a two way split. Select the best answer Avoid large capital purchases On-demand capacity Go global Increase speed and agility All of the above What is the pricing model that allows AWS customers to pay for resources on an as-needed basis. 4280 in rent for the manufacturing corporate office.

No the FLSA does not require hazard pay. 300 electric bill for manufacturing facility. Analysts and investors expect Alpha to increase its dividends at a 15 percent rate for each of the next 2 years.

Study with Quizlet and memorize flashcards containing terms like What are the advantages of cloud computing over on-premises. Standard Hours SH X. Card A manufacturing company accumulates the following data on variable overhead.

3120 in marketing materials and ads. Learn more about the increase. 048 per piece Direct labor.

Quantity 17280 - 35000 x 05lb x 1 lb 220 Favorable. The labor law also stipulates that employees are only allowed to work for 8 hours a day which includes a long break of up to one hour. Wages means the direct monetary compensation for labor or services rendered by an employee where the amount is determined on a time task piece or commission basis excluding any form of supplementary incentives.

FLSA generally requires only payment of at least the federal minimum wage currently 725 per hour for each hour worked and overtime compensation for each hour more than 40 worked in a workweek in the amount of at least one and a half times the employees regular rate of pay. This result means the company incurs an additional 3600 in expense by paying its employees an average of 13 per hour rather than 12.

Labor Cost Variance Meaning Formula And Example

Establish A Direct Labor Budget As Part Of Your Master Budget Dummies

No comments for "Compute the Standard Direct Labor Rate Per Hour"

Post a Comment